How Ryan and Anna Found a Deal with an ARV of $175,000 (And Four Tips to Follow Before Making a Property Deal)

You’ve found a deal that looks the part. But before you jump in, there are a few things you need to do.

Let’s talk about a deal that two of my clients, Ryan and Anna, found recently.

On paper, everything looks fantastic.

The property has a potential After Repair Value (ARV) of $175,000, and that could go into the couple’s pockets after a little renovation work. On top of that, there’s potential for the property to generate $1,400 per month in rent, which is more than enough to pay the costs of running the property.

So, we see substantial growth potential and an excellent rental yield.

But that’s not all!

The couple planned to get a mortgage offering a 75% Loan-to-Value (LTV) ratio. That means solid equity placed into the property from the beginning and less interest to pay throughout the loan.

As we said, it looks like a fantastic deal on paper.

The question now is…

Should Ryan and Anna go for it?

All of these early signs indicate they should. But at the same time, the ...

HEL vs HELOC

"Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world."

- Franklin D. Roosevelt, U.S. President

Real estate business and investing is a never-ending process of learning.

In this case, we're talking about Home Equity Loan (HEL) and Home Equity Line Of Credit (HELOC)

As the borrower, HEL provides you with a single lump-sum payment and is repaid at an agreed-upon interest rate over a set time (usually five to 15 years). Over the loan's lifetime, the payment and interest rate usually remains the same. When the home on which it is based is sold, the loan must be repaid in full.

Whereas a HELOC is a revolving credit line, which, for a term determined by the lender, you can draw on as needed, pay back, and then draw on again. HELOCs typically have a variable interest rate, but some lenders offer fixed-rate options.

In other words, it's a credit l...

How many rentals do I need to retire?

Achieving a vision starts with creating one. As a high paid stressed out corporate couple with children, one gets used to a life that is defined by steady paychecks with a promise of a few percent of increase in pay each year and a few weeks of vacations. But if you think outside the box, there is a whole new world waiting for you to explore.

When I was working at my corporate job as a mechanical engineer for 16 long years, I realized that I was not building any other wealth at that job. Yes, the salary was high, but my ceiling was fixed and defined by my superiors. I did not have the control of my own destiny. I wanted a path where I could define my own growth. And Real Estate investing has been that and so much more. It not only allowed me to build wealth and replicate my six figure income, it allowed me to explore my own fullest potential.

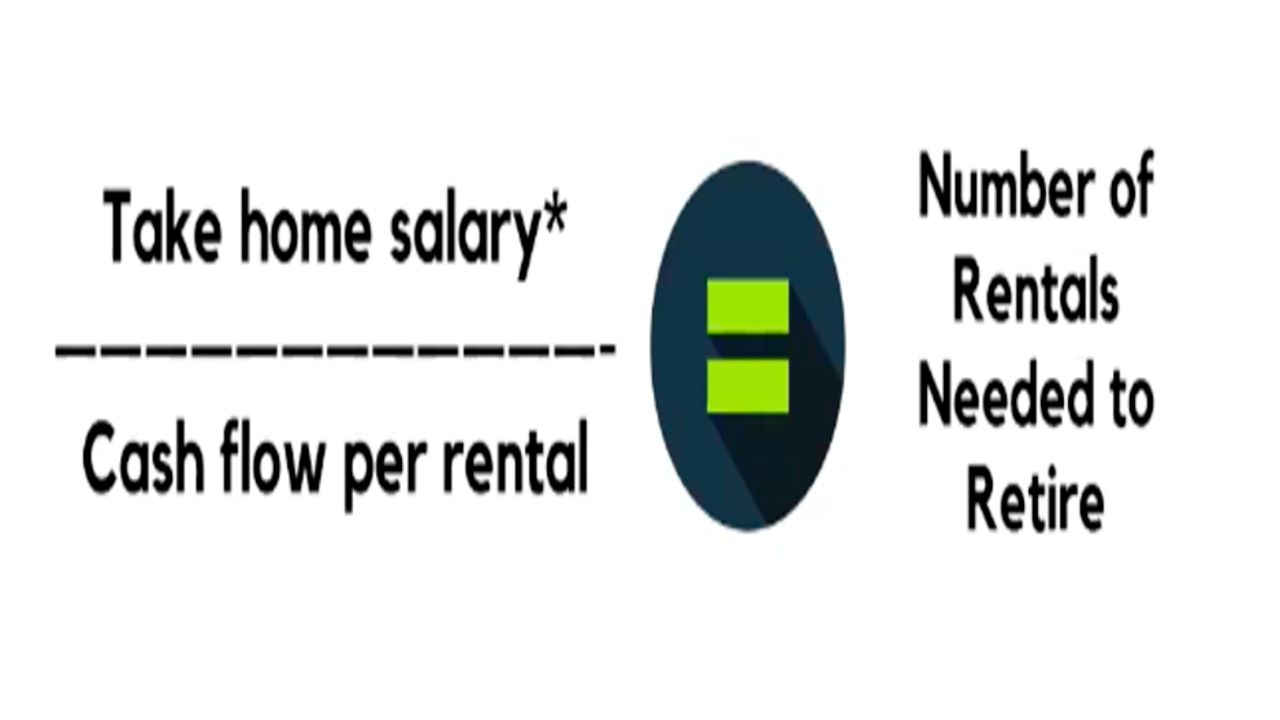

As you start your journey, use this formula to figure out the number of rentals you will need to retire. It will help put a number to your...

How One Investor Made $190,000 Equity on a Single Real Estate Project (And Four Tips for New Investors)

New investors can easily be overcome with fear when faced with challenges, preventing them from going all-in in property investing. Learn what it takes to be a successful and fearless investor.

With the right investing strategy, just one investment property can generate a significant amount of equity. And one shining example of that is the experience of one of the investors who worked with us.

This investor now expects to see $190,000 in equity from a single property once the project reaches completion. But prior to that, she had done another deal wherein the results were a far cry from those figures - it was nowhere near that amount of equity.

Such a result can easily deter a new investor from moving forward in their property investing journey.

But where some people would have given up, she pressed on. She created a game plan and stuck with it. And soon, she’ll reap the rewards of doing so.

This investor is proof positive that even if you start small, it’s absolutely possible to ...

Property not renting? Use the VSAP method

Filling up vacancies is one of the things that beginner real estate investors find extremely challenging. A high vacancy rate can be a major blow to the Net Operation Income (NOI). A poor NOI will have a negative impact on almost every aspect of your investment goals. It will not only reduce the cash flow, but also decrease the property’s market value.

If you are having a hard time renting your property, I would recommend that you use my tried-and-tested ‘VSAP’ method. The acronym stands for Views, Showings, Applications and Pool.

Here are a few tips you will find useful in implementing the ‘VSAP’ method:

- Listing improvement: Most tenants start their search for a rental online. Since the property listing websites are inundated with rental listings, you need to grab tenants’ attention with better photos and descriptions. Write a description that addresses the pain points of your target tenants. For example, if you are listing smaller units, you can highlight how they make the opti...

How I created a $4M rental portfolio in 2 years by supercharging the BRRRR strategy

As a corporate couple with two young children, my husband and I led stressed out lives. I remember one instance where I was on a conference call while pumping in my office which had newspapers that covered the windows and thinking to myself, is this why I worked so hard for 17 years to build a career? After I quit my job and moved over to full time Real Estate Investing, I used my skills as an Engineer and leveraged my knowledge on building systems, teams and processes that I had acquired while climbing the corporate ladder to exponentially grow my portfolio. It wasn't until I was celebrating my son's third birthday, that I remembered that I had put my first BRRRR property under contract on his first birthday and that it had only been two years. In my recent Biggerpockets podcast interview, I have talked about all of the following and much more. I'd love for you to check it out and also give me some feedback on what resonated with you over on instagram at @openspaceswomen.

Here a...

Busy Work or Life's Work

“On the one hand, we all want to be happy. On the other hand, we all know the things that make us happy. But we don’t do those things. Why? Simple. We are too busy. Too busy doing what? Too busy trying to be happy.”

—Matthew Kelly, Bestselling Author

In 2016, I gave birth to my second child, my son. A few months later, I decided to become a full time investor and entrepreneur. I put my first BRRRR (Value add investing) property under contract on his first birthday. Two years later, when he turned three, I had built a $4M portfolio. In 2019, our revenue crossed the $1M mark. I launched the coaching arm of my business in 2019 too. I have been mentoring others who are interested in Real Estate Investing for the past couple of years and seeing my students' consistent success, I realized I was good at presenting complex ideas in simple, easy to follow way and felt fortunate to have the freedom to create another business. This whole time, I would take at least one or two days off each we...

Dare to dream big!

“The great danger for most of us lies not in setting our aim too high and falling short; but in setting our aim too low, and achieving our mark."

~Michelangelo

My goal was to spend more time with my family. My dream was to achieve financial independence, to become my own boss and grow to reach my fullest potential. Once I started and stabilized my business to go towards the path of achieving this dream, I found myself falling into the abyss known as "hustling". Hustling is often the way of life for entrepreneurs - it is the driving force behind a lot of decisions made on the go and it requires constant hard work. Hustling is captivating, motivating and an adrenaline rush, and most importantly, it helps an entrepreneur get their business up and running. However, it is very important to come out of the hustle mindset, because in the long run, it can be disruptive, derailing and can eventually burn one out.

This blog is a case against hustling! The biggest reason why I am making th...

Four elements on Choosing a Property Manager

After many personal experiences – good and bad –hiring property management companies and managing properties on our own, we’ve figured out some key elements to keep in mind when choosing a property management company. Here are four that we think lead to a successful business partnership.

1. Integrity

It may seem like a cliché to put integrity on the top of the list; however, a property manager’s decisions and actions have an effect on the property owner’s profit. Tracing the actions and decisions that result in a lower return on investment after the fact is difficult.Therefore, integrity is the most important component to look for from the onset. The best way to find out whether the property manager in question is reputable to use the following tools:

• Have a face to face meeting to get a sense of the person or team and their attitude.

• Check references from current property owners who entrust their property to the property manager.

• Check the Better Business Bureau for complai...

Lessons Learned From Theft At a Project

“The fight is won or lost far away from the witnesses, behind the lines, in the gym, and out there on the road; long before I dance under those lights.”

~Muhammad Ali

We just finished rehab on a new rental property in a great location in Philadelphia, close a major transportation hub and a University. However, majority of the work in entrepreneurship is not glamorous. These are stories that don't come with cool shiny photos, these are stories that will definitely not make it to Instagram. This post is highlighting one of those stories and the lessons learned from that. I wanted to share this because it will help a new investor navigate through adversities in their journey. The day we closed on the property, right before we could even change the locks, there was an unfortunate theft at this property. One of the items stolen was the boiler among many other things. My contractor called me genuinely upset about this. A theft can leave one feeling violated and we have managed to m...